Equity indexes edged lower on Wednesday while oil prices tumbled as investors trudged toward 2023 weighing hopes for a potential economic boost from China’s lifting COVID-19 restrictions against concerns about rising infections there.

The yield on the benchmark U.S. 10-year Treasury turned higher after falling earlier, following its biggest one-day jump in just over two months on Tuesday.

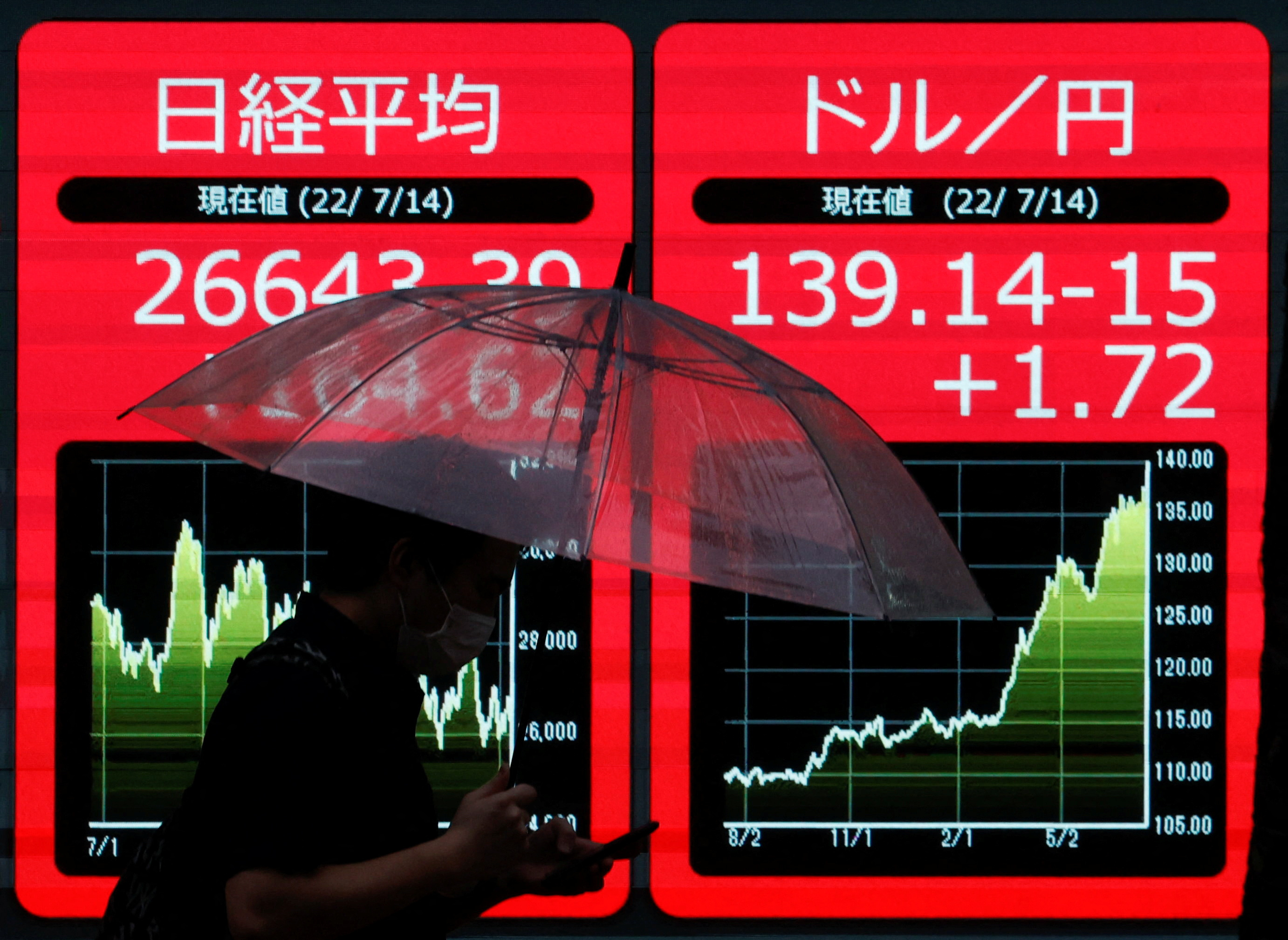

In currencies, the dollar pared some gains after hitting a one-week high against the yen and it regained some ground against sterling after earlier falling sharply.

MSCI’s broadest index of global stocks (.MIWD00000PUS) was down 0.54% as investors stayed on the sidelines at the end of a brutal year for equities. The global index is on course to end 2022 down about 20%, in its biggest percentage decline since 2008 during the financial crisis.

China’s government had announced on Monday that they would end requirements for inbound travellers to quarantine on Jan. 8. The country’s health system has come under heavy stress since lifting restrictions. But strategists at JP Morgan forecast a “likely infection peak” during the Lunar New Year holiday next month, followed by a “cyclical upturn.”

Thomas Hayes, chairman at Great Hill Capital LLC in New York, expects reopening of the world’s second largest economy to ultimately benefit the U.S. economy even if the current uptick in infections is raising concerns.

“The speed at which they have reversed their stance has caught people off guard. People are sceptical because the last two years have been such a debacle in China,” said Hayes.

But Amit Sinha, head of multi-asset strategy at Voya Investment Management, said Tuesday’s stock declines are the result of “noise” including low liquidity and so-called tax loss harvesting where investors sell money-losing investments.

“Today there’s nibbling away at risk and selling for tax loss harvesting purposes,” said Sinha. “Markets have been going down for the course of December. There’s a negative sentiment and momentum already.”

And with uncertainty about 2023 abounding due to questions such as when the U.S. Federal Reserve can cut interest rates and whether it can control inflation without damaging the economy, Sinha sees “reasons why people want to sell.”

“There’s no compelling reason to be on the other side. It exaggerates the price decline,” he said.

The Dow Jones Industrial Average (.DJI) fell 167.43 points, or 0.5%, to 33,074.13, the S&P 500 (.SPX) lost 24.18 points, or 0.63%, to 3,805.07 and the Nasdaq Composite (.IXIC) dropped 93.23 points, or 0.9%, to 10,260.00.

In Treasuries, benchmark 10-year notes were up 2.7 basis points to 3.885%, from 3.858% late on Tuesday. The 30-year bond was last up 3.1 basis points to yield 3.9738%, from 3.943%. The 2-year note was last down 0.9 basis points to yield 4.3594%, from 4.368%.

“If the 10-year gets to 4%, the floodgates are going to open, there will be a lot of buying at that level,” said Jay Sommariva, managing partner and chief of asset management at Fort Pitt Capital Group in Pittsburgh.

In foreign exchange markets, the dollar index rose 0.202%, with the euro down 0.17% to $1.062.

The Japanese yen weakened 0.64% versus the greenback at 134.34 per dollar, while Sterling was last trading at $1.2028, up 0.06% on the day.

Oil prices regained some lost ground by settlement as traders weighed COVID news from China.

U.S. crude settled down 0.07% at $78.96 per barrel while Brent finished at $83.26, down 1.27% on the day.

Gold prices dropped about 1% earlier in the session as higher Treasury yields weighed and after the precious metal reached a six-month peak on Tuesday.

Spot gold dropped 0.5% to $1,805.39 an ounce. U.S. gold futures fell 0.55% to $1,808.80 an ounce.

Related Galleries: