Shares of some listed Adani group companies, including its flagship, rose in early trade on Tuesday while others fell further as the reverberations from a U.S. short-seller’s critical report on the Indian conglomerate continued to be felt.

The sell-off was unabated in some companies even as the group announced it is pre-paying $1.11 billion of loans on shares ahead of their maturity in 2024. Adani group’s seven listed companies have lost $110 billion in cumulative stock market value since Hindenburg Research’s report was released on Jan. 24.

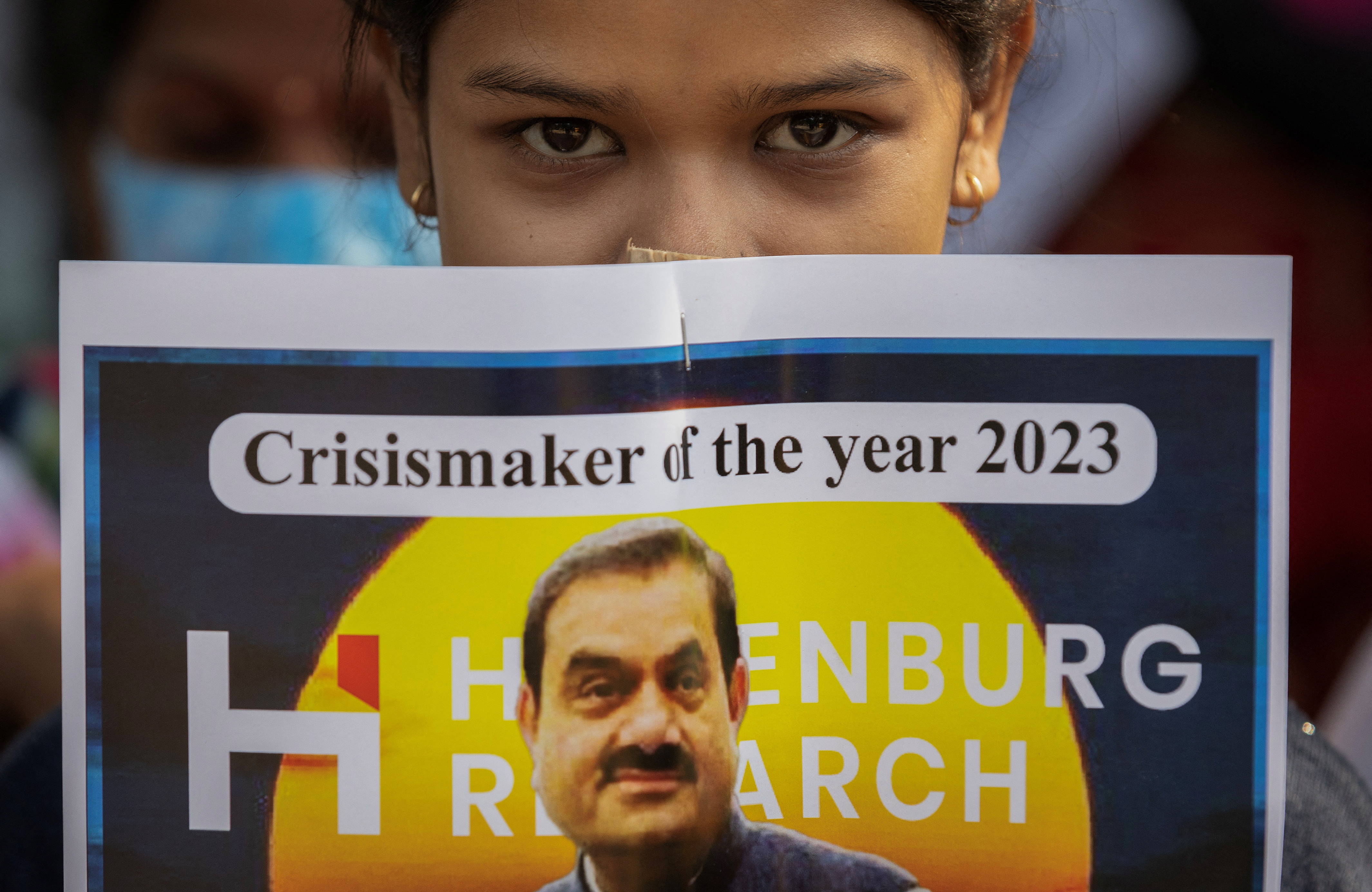

The crisis in the group spilled over to the streets on Monday, with hundreds of members of India’s main opposition Congress party protesting and pressing for a probe into Hindenburg’s allegations of stock manipulation and use of tax havens by Adani, which the conglomerate has denied.

Indian bourse National Stock Exchange of India (NSE) revised the maximum daily permissible limit for price moves for Adani Green Energy Ltd (ADNA.NS) and Adani Transmission Ltd (ADAI.NS) to 5%, according to data on its website on Monday.

Shares of Adani Green Energy, Adani Total Gas Ltd (ADAG.NS), Adani Power (ADAN.NS) were down 5%, while Adani Transmission rose 3.5%.

The group’s flagship company, Adani Enterprises Ltd (ADEL.NS), was up 9.5% and Adani Wilmar (ADAW.NS) gained 5%.

Adani Ports and Special Economic Zone (APSE.NS) also edged up 7.7%.

Related Galleries: