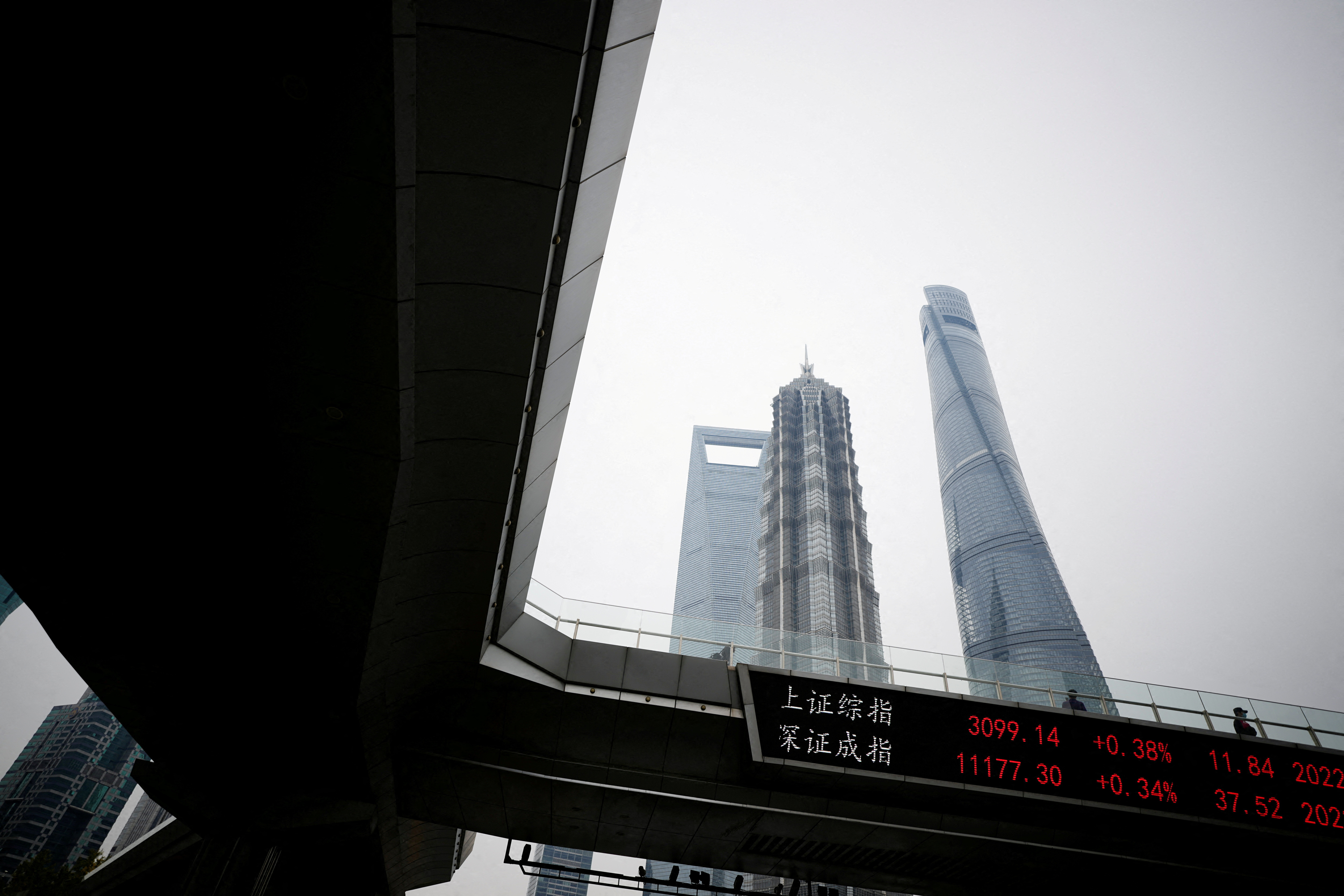

Asian stocks sagged on Thursday, tracking declines on Wall Street after the U.S. Federal Reserve projected higher interest rates would persist for a while.

U.S. Treasury yields remained depressed and the curve deeply inverted as traders continued to fret that tighter policy would trigger a recession. The U.S. dollar languished near a six-month low against major peers.

Rising COVID-19 infections and disappointing economic data in China also weighed on the mood. Crude oil shed some of Wednesday’s strong gains.

Japan’s Nikkei (.N225) eased 0.42%, while South Korea’s Kospi (.KS11) dropped 1.32% and Australia’s stock benchmark (.AXJO) fell 0.64%.

Hong Kong’s Hang Seng (.HSI) tumbled 1.13% and mainland Chinese blue chips (.CSI300) declined 0.15%.

MSCI’s broadest index of Asia-Pacific shares (.MIAP00000PUS) slumped 0.94%, after climbing as high as 160.37 in the previous session for the first time since late August.

Overnight, the U.S. S&P 500 (.SPX) lost 0.61%, although e-Mini futures pointed to a slight 0.09% bounce for Thursday’s reopen.

Europe was headed for a lower open, with Dax futures indicating 0.37% weaker and FTSE futures slipping 0.09%.

Fed Chair Jerome Powell said on Wednesday that the central bank would deliver more rate increases next year even as the economy slips towards a possible recession, arguing that a higher cost would be paid if the U.S. central bank does not get a firmer grip on inflation.

The comments followed the Fed’s decision to raise the benchmark rate by an as-expected half a percentage point – down from recent 75 basis point increases – but projected a terminal rate above 5%, a level not seen since a steep economic downturn in 2007.

“This is a very hawkish signal from the Fed: a substantially higher terminal rate than back in September that also has a real upside risk attached to it,” TD Securities analysts wrote in a research note.

“The Fed essentially acknowledged at this meeting that inflation is likely to remain stickier than initially expected, necessitating a more restrictive policy stance, which will end up pushing the U.S. economy in a recession in 2023,” they added. “The weakening in risk assets and the flattening of the curve suggest that recession fears may be the dominant driver of market price action.”

The 10-year Treasury yield slipped to 3.49% in Tokyo trading, with the two-year yield also edging lower to 4.24%.

The spread between them widened slightly to negative 75.2 basis points. An inverted yield curve has been a reliable indicator of recessions in the past.

The dollar index – which measures the greenback against six top peers, including the euro and sterling – held close to the overnight low of 103.44, a level not seen since June 16. It last stood 0.16% stronger at 103.82.

Some analysts interpreted the reaction in rates and currency markets as a sign that traders doubt Powell’s policy narrative, retaining bets for an earlier easing of inflation and sooner Fed pivot.

“In essence, the market is still of the view that inflation heads towards target in 2023,” Chris Weston, head of research at Pepperstone, wrote in a client note. “The likely result in a potential standoff between the Fed and the markets is volatility.”

The euro eased 0.22% to $1.0659, but still near Wednesday’s more-than-six-month peak at $1.0695.

Sterling edged 0.28% lower to $1.2393, remaining not far from an overnight top at $1.2446, also the strongest in just over six months.

Investors’ eyes will now be trained on policy decisions from the European Central Bank and Bank of England later in the global day, as officials there also stood ready to hike rates again against the rising risks of fomenting recessions.

Crude oil gave back some of its gains from overnight, when it was cheered by projections from OPEC and the International Energy Agency of a rebound in demand next year, partly driven by China’s reopening.

China’s economy, however, lost more steam in November as factory output slowed and retail sales extended declines, hobbled by surging COVID-19 infections and widespread curbs on movement.

Brent crude futures fell 64 cents, or 0.8%, to $82.06 per barrel after closing Wednesday’s session up $2.02, while U.S. crude futures slid 74 cents, or 1.0%, to $76.54, following a $1.94 rise the previous session.

Related Galleries: